The topic of this teaching unit is the formation of prices, on markets in general and on well-organised and transparent markets (e.g. a commodities exchange) in particular. With the aid of a game, students experience first hand how markets function.

The unit is a good introductory tool, explaining basic concepts such as price formation on markets, equilibrium, supply and demand, trading profit and market efficiency; it also offers some deeper insights into selected points.

The main element is ‘Pitgame’, a game that is played in class and is supported by a browser-based, interactive presentation. Playing the game requires a computer with internet access and a connected projector (or any other method that allows all players to view the game screen).

The interactive presentation can be launched via pitgame.iconomix.ch. Technical requirements are an internet connection and an up-to-date browser (Chrome, Edge, Firefox, Safari).

Two to four lessons, depending on the degree of detail with which the topic is addressed.

Economics and law (GYM), economics and social studies (KV).

Intermediate. The game itself can be used in a wide range of contexts, however the follow-on tasks (worksheets) can be configured as appropriate, depending on how advanced the students are. Worksheets 1 and 2A are suitable for all types of schools. The worksheet 2B is intended as an optional supplement for GYM and BM.

The unit consists of this commentary for teachers and the following teaching material:

| The students can… |

| … compare findings from the evaluation of the game with economic theory and observations from everyday life. |

| … explain how a market price is formed in a well-organised market and what an equilibrium price is. |

| … explain what is meant by trading profit and market efficiency. |

| … explain the effects of taxes, subsidies and minimum prices on supply, demand and the equilibrium price (GYM/BM only). |

In 1948, Edward Hastings Chamberlin (1899–1967), an American economist, published a paper in which he developed the Pitgame market experiment. His goal was to demonstrate systematic divergences from the accepted theory of perfect (or perfectly competitive) markets. Paradoxically, today his experiment is very well suited to teaching students (and not just those studying economics) about basic concepts such as price formation on markets, equilibrium, supply and demand, trading profits, and market efficiency

For details on the economic concepts taught, refer to the intro text.

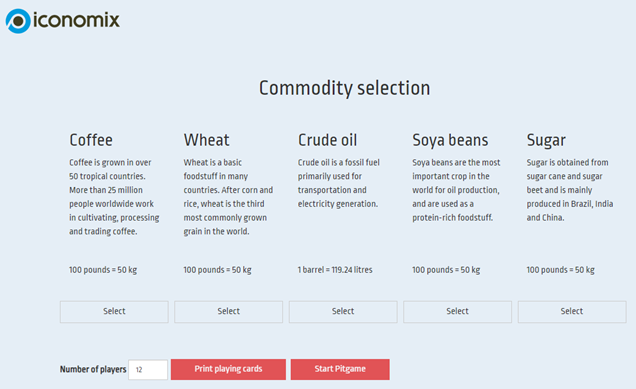

In Pitgame, students take on the role of traders on a commodities exchange. Their goal is to purchase the commodity at the lowest possible price or sell it at the highest possible price. The maximum purchase price or minimum sale price is specified on each student’s playing card.

A minimum of 12 players is required for the game. Game preparation, as well as playing the game and evaluating it in class, are supported by the interactive, browser-based presentation.

The teaching material is designed with a pro-active and problem-solving approach in mind (see www.iconomix.ch/didactics). The targeted skills can be developed in three phases, as follows:

Phase 1: Engage with the material

In the first phase, the students play Pitgame. The teacher oversees the game and keeps a record of the completed trades, unless this role has been delegated to a (proficient) student.

Phase 2: Discuss and reflect

The second phase involves an evaluation and a session in which the students reflect, either individually or in groups, on the way the Pitgame simulation went.

Reflecting on how the game went, individually or in the group

Once Pitgame is over, the participants think about how they played the game. A set of written questions guides this process (Worksheet 1). The idea here is that students explore why they made certain decisions at certain times and thereby gain an understanding (still partly intuitive at this stage) of the price mechanism.

Evaluation using interactive presentation

The students examine the evaluation charts and the table in the interactive presentation (can be printed out using the ‘Print’ function in the browser).

With the help of the written questions 4 to 8 in Worksheet 1, they then interpret their own observations and see how they relate to the concepts of equilibrium, supply and demand. The teacher oversees the discussion and provides assistance as needed.

Phase 3: Practise and apply

This phase is all about consolidation and transfer – the students can reinforce the skills they have acquired through practice and expand their skills by tackling more challenging tasks.

Two documents are available for this phase:

Supplement for GYM and FVB:

‘Competitive Market Game’ by MobLab

The online simulation ‘Competitive Market’ by MobLab is an ideal extension of the Pitgame. The simulation allows students to playfully experience the effect of the introduction of taxes, subsidies or minium prices on supply, demand and the equilibrium price.

The simulation is in English and access is free of charge for Iconomix users:

| Steps | Description | Media/material | Time | |

|---|---|---|---|---|

| Phase 1 Engage with the material 45 minutes | Introduction | Introduction to ‘Pitgame’ | ‘Introduction to Pitgame’ slides, computer and video projector | 10 minutes |

| Game | Starting the game | Interactive presentation Pitgame, computer and video projector | 35 minutes | |

| Phase 2 Discuss and reflect 40–65 minutes | Evaluation and reflection | Evaluation of the game based on the key questions from worksheet 1, individually or in pairs. Discuss the result in the group. | Worksheet 1, sample answers | 30–45 minutes |

| Theory | Study intro text (possibly as homework) or teacher presentation | Intro text | 10–20 minutes | |

| Phase 3 Practise and apply 45–90 minutes | Transfer tasks | Complete transfer tasks individually or in pairs | Worksheet 2A, sample answers | 45 minutes |

| Transfer tasks (advanced, optional) | Complete transfer tasks individually or in pairs | Worksheet 2B, sample answers | 45 minutes |

The reservation prices merely provide a fairly wide price range; even within this range, it is possible for prices to diverge widely from the equilibrium price. For example, a buyer and a seller who each have an extremely low reservation price could agree to trade at a price well below the equilibrium.

Simply to ensure that it’s not always the same players who find themselves with little or no chance of making a trade.

This was done for practical reasons. It makes it possible to prepare the game in advance (and no time is wasted in class). Anyway, the game would not be very different if the players set the reservation prices themselves. The important point is that the players have to decide how much to concede during trading.

At some point, every buyer reaches an upper price threshold above which they would stop buying a product. The only unnatural thing is that in the game this threshold is written down, rather than being a subconscious concept, as is often the case in real life. Likewise, every seller also has a lower price threshold. We could also postulate that the players are traders who receive orders in which their customers set binding limits.