When you retire, from one day to the next you no longer have a wage. But you still have to cover your usual costs of living. This means that to be able to maintain your accustomed standard of living, you have to start putting aside long-term savings for life after retirement at an early stage. The state and private mechanisms for doing so come under the umbrella term of retirement provision.

Retirement provision in Switzerland consists of multiple components, the so-called three-pillar system. The two most important state mechanisms are Old-Age and Survivors’ Insurance (OASI) and the occupational pension (pension fund) scheme. Added to these is the third pillar, independent provision (private savings).

The first pillar, the OASI pension, is only designed to cover basic living expenses. To be able to maintain a similar standard of living as you had while you were working, you need an additional pension from an occupational pension (OP). For this reason, this particular function of occupational pensions is also known as income smoothing. People generally refer to their occupational pension as their pension fund.

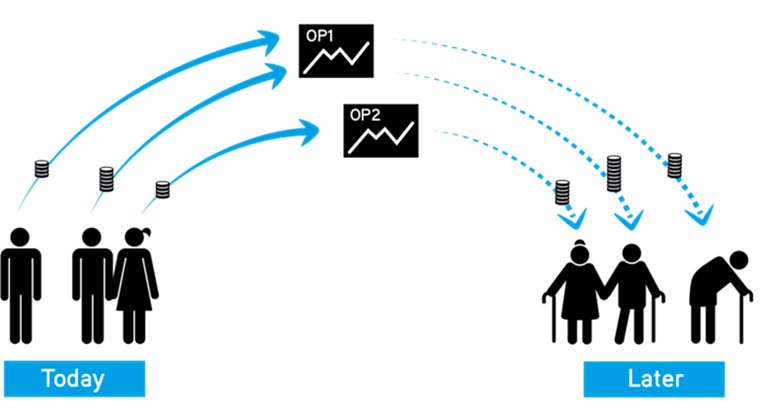

Working people pay regular contributions into a personal account at a pension fund. This money is deducted directly from their pay. In addition to this, their employer pays at least the same amount into the pension fund. The money in the pension fund is blocked until the person retires. Early withdrawal is only possible to finance home ownership, when taking up self-employment, when leaving Switzerland or when taking early retirement. After retirement, the person receives a monthly pension. The assets they have accumulated are thus drawn gradually until the end of their life. The whole system runs on a fully-funded basis. Unlike OASI, occupational pension schemes are not organised by the state, but by private providers such as pension foundations, banks and insurance companies.

Unlike OASI, there is no blanket requirement to belong to an occupational pension fund. It is only compulsory for employees to pay into a pension fund from the age of 25 and an annual income of CHF 22,680 (as at 2025). Anyone earning less than CHF 22,680 or who is self-employed does not have to pay pension fund contributions, although these people can join a pension fund voluntarily. Since there is no blanket requirement to belong to a pension fund, not all people of retirement age receive an occupational (second pillar) pension when they reach retirement age. This is mainly a problem for people who only work part-time.

![]()

![]()

![]()

![]()

The example below shows the development of contributions (right-hand scale) for a gross salary of CHF 60,000 (left-hand scale).

![]()

During the course of a person’s working life, the pension fund invests the money on the capital market, in other words on the stock and bond markets. There it earns a return over the years and thus grows. The OP contributions paid in plus the returns give the person’s retirement assets. This money is then available to them on retirement. Pension fund members can decide whether they want to withdraw their savings all at once in the form of a lump sum payment or in the form of a regular pension. It is also possible to combine a regular pension and a lump sum payment. If a person lives beyond the average life expectancy, the regular pension solution pays off. The average life expectancy is around 81 years for men and around 85.1 years for women (as at 2020).

A person’s occupational pension is calculated on the basis of the retirement assets they have saved multiplied by the so-called conversion rate. This conversion rate determines how much of the money saved is available every year. The rate is currently 6.8% (as at 2025).

Like the salary, the pension is paid on a monthly basis, regardless of how long the person lives or how much of their accumulated capital is still left. The life span of a pension fund member therefore determines how much of the money they have saved they receive back as a pension.

Calculation of monthly OP:

CHF 500,000 (example of accumulated retirement assets) x 6.8% = CHF 34,000 (OP per year)

CHF 34,000 / 12 months ≈ CHF 2,833 (OP paid out every month)

Thanks to advances in medicine and technology, people now live longer than when the occupational pension scheme was introduced back in the 1980s. This leads to the challenge that more and more people are drawing more money from the pension fund than their accumulated retirement assets would permit. The reason is that the current minimum conversion rate assumes an average life expectancy of 80 years. So pensioners who draw an occupational pension for more than 15 years receive more money than they saved during their working life (cf. fig. 2). The current minimum conversion rate of 6.8% is thus too high when measured against today’s life expectancy.

Pension funds are able to partially mitigate the problem of the minimum conversion rate being too high by earning good returns on the financial markets. This leads to an increase in retirement assets overall. For this reason, the capital market is also called the ‘third contributor’ alongside employees and employers. However, the relative importance of the third contributor is strongly dependent on developments in the financial markets and, in particular, on interest rate movements. Furthermore, a pension fund cannot invest its money as freely as a private individual. To guarantee that pension provision is secured, pension funds must fulfil many statutory requirements.

At present the excessively high expenditure is being offset by paying out the pension fund assets of people who are still working to the current generation of pensioners. This goes against the principle of a fully-funded system and amounts to redistribution. The result is that subsequent generations may no longer have the full amount of the money they have paid into the pension fund at their disposal.

There are two main approaches to ensuring that it will also be possible to pay out occupational pensions in the future without redistribution: