A central bank has a clearly defined mandate: It must pursue a monetary policy that serves the interests of the relevant country or currency area as a whole. Its primary goal is to ensure price stability. In other words, the central bank seeks to avoid a sustained price increase (inflation) or a sustained price decrease (deflation), both of which would cause major fluctuations in the purchasing power of money

Price stability is an important prerequisite for growth and prosperity. Inflation and deflation, by contrast, impair economic development. They make it difficult for households and companies to plan on a reliable basis. Moreover, they hinder the role of prices in allocating labour and capital to their most efficient use, and result in a redistribution of income and wealth.

As a second goal, a central bank often aims for well-balanced economic development. This means that a country’s economy should neither be allowed to overheat nor cool off considerably. Such a stable environment is characterised by sustainable economic growth and low unemployment. Since there is generally no conflict of interest between well-balanced economic development and price stability, a central bank can often pursue both goals at the same time.

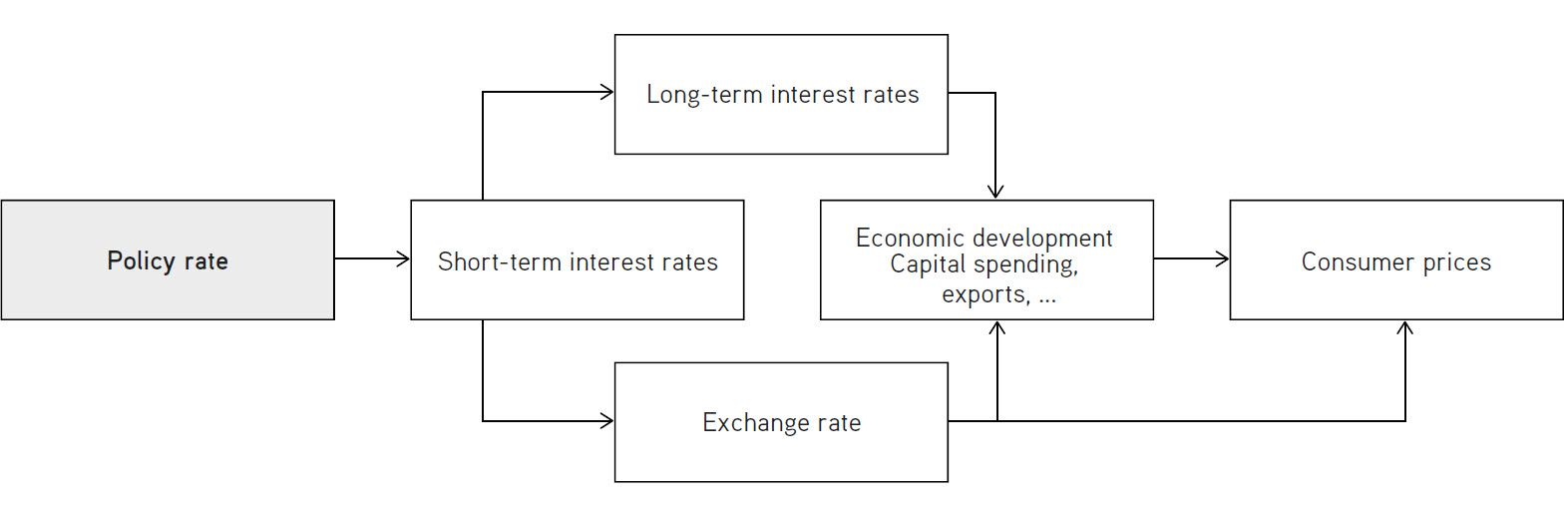

A central bank implements its monetary policy by setting the policy rate (cf. ‘SNB policy rate’ box). It thereby steers the interest rate level on the money market, where banks lend each other money in the short term. Since these are short-term transactions, we talk about short-term interest rates in the following. Diagram 1 shows the two channels of transmission that a central bank triggers when it changes the policy rate:

The upper path illustrates how an interest rate change affects the granting of credit, which is why it is also known as the credit channel of monetary policy. The lower path shows the effects of an interest rate change via the so-called exchange rate channel.

An increase in the policy rate by the central bank leads, via a sort of chain reaction, to higher general borrowing costs in the economy. Not only do short-term loans become more costly, but the interest rates for long-term loans and the yields on bonds (known as long-term interest rates) increase as well. For instance, house owners need to pay more interest on their mortgages as a result, and capital costs for corporate loans increase as well

Conversely, if the central bank lowers the policy rate, this has the opposite effect. The borrowing costs in the economy decrease, thereby stimulating economic activity and inflation.

In Switzerland, the Swiss National Bank (SNB) pursues its monetary policy goals by setting the SNB policy rate. This rate indicates the interest rate level that the SNB targets for secured short-term money market rates. The most representative of these money market rates is SARON (Swiss Average Rate Overnight), which is the interest rate at which banks lend each other money in the short term (i.e. overnight) against collateral such as government bonds. The SNB seeks to always keep SARON close to the SNB policy rate. To this purpose, it can intervene directly in the money market.

For a country like Switzerland, which has a small and internationally highly integrated economy as well as a currency of global significance, the lower part of the diagram is particularly important. It shows that the exchange rate, too, has a considerable influence on economic activity and inflation.

At the same time, higher interest rates also strengthen the domestic currency by making investments in this currency more attractive. As a result, more people, both within the relevant country and abroad, will want to invest their money in the domestic currency. To do so, they first have to exchange foreign currency against domestic currency. This increases demand for the domestic currency, which appreciates accordingly. Due to this appreciation of the domestic currency, exports to other countries become more expensive, whereas imports become cheaper. Demand for domestic goods thus declines both domestically and abroad, which has a dampening effect on domestic economic activity and, ultimately, on inflation.

Conversely, lower interest rates make the domestic currency less attractive, causing it to depreciate. This stimulates exports and thus economic activity, while making imports more expensive. Inflation increases as a result.

The conduct of monetary policy is both complicated and facilitated by a number of particularities which cannot be deduced directly from diagram 1.

Delayed effects: It may take some time before central bank monetary policy decisions produce an effect. This applies in particular to the upper part of diagram 1. A change in short-term interest rates impacts prices in a country with a time lag of two to three years. The central bank takes account of this slow reaction by adopting a forward-looking approach when formulating its monetary policy, preparing forecasts on the future development of the economy and inflation. If it reacted only once inflation was increasing or decreasing, this would be too late.

Temporary impact on economic growth: The effect of monetary policy on the economy is always only temporary. The long-term growth of a country’s economy (i.e. the trend growth) depends on other factors, notably the size of the working population, the level of education, physical capital, technological progress and the quality of the institutions, such as the system for the protection of ownership rights. In other words, the stimulating effect of an interest rate cut on the economy evaporates after some time; what remains is a higher price level. Therefore, the primary goal of monetary policy is not to achieve a growth target, but to ensure price stability, as the latter can actually be influenced by a central bank in the long term.

Utilisation of economic capacity: The effect that monetary policy measures have on inflation depends on the utilisation of economic capacity, and thus on the business cycle. During a recession, a central bank can lower interest rates and thereby stimulate demand without this causing prices to increase immediately across the board. The reason for this is that, in an underutilised economy (i.e. with high unemployment, empty company order books and underutilised production capacities), inflationary pressure is low

The role of expectations: Well-anchored inflation expectations facilitate the implementation of monetary policy. If households and companies expect the central bank to continue to achieve its predefined inflation target, consumers and companies are less likely to react should inflation temporarily climb above this level (e.g. due to a hike in the oil price) or temporarily fall below it (e.g. due to a recession). Amid stable inflation expectations, it is thus easier for a central bank to keep inflation under control despite temporary fluctuations.

A central bank does not make its monetary policy decisions in a vacuum, but it reacts to economic developments. This is visualised in diagram 2:

The central bank monitors economic and inflation developments at home and abroad, prepares economic and inflation forecasts, compares the developments with its goals – and then reacts accordingly by making a monetary policy decision, generally by setting the policy rate.

If the central bank identifies significant discrepancies between the economic and inflation developments on the one hand and its goals on the other, it adjusts its monetary policy accordingly. If there is a danger of overheating, it steps on the brake by increasing the policy rate so as to prevent inflation from surging to undesirably high levels and the economy from overheating. Conversely, if there is a risk of recession, it steps on the accelerator by lowering the policy rate in order to prevent inflation from falling to undesirably low levels and the economy from slipping into recession. Ultimately, this is a constant balancing act, associated with the goal of preventing sharp swings in the economy and in inflation. In this way the central bank fulfils its mandate, ensuring price stability while taking account of economic developments.

Steering short-term interest rates in an environment in which these rates are already very low is difficult because interest rates cannot be lowered indefinitely. When companies and households are faced with strongly negative interest rates, they switch to cash, which bears no interest. Slightly negative interest rates, however, are acceptable

In such an environment, the central bank can further ease monetary policy by trying to directly influence not only short-term interest rates, but also long-term interest rates and the exchange rate (cf. diagram 1). Therefore, even if money market rates are low, a central bank still has some instruments at its disposal to achieve its goals. We call these instruments unconventional monetary policy measures. First, the central bank can acquire longer-term assets, such as government bonds, directly on the capital markets, thereby lowering long-term interest rates. Second, it can purchase foreign currencies through foreign exchange market interventions and thus influence inflation via the exchange rate channel.

In addition, the central bank can influence expectations of the markets and the public regarding the future development of short-term interest rates by announcing its intention to keep the policy rate low in the long term. Provided that the financial markets and the public consider such an announcement to be credible, it has an impact on long-term interest rates.

Following the onset of the euro area debt crisis in 2010, the Swiss franc appreciated rapidly and steadily as many investors considered it a ‘safe haven’ compared with other currencies. To counteract this development, the SNB introduced a minimum exchange rate of CHF 1.20 per euro in September 2011. It thereby supported the Swiss economy and ultimately ensured price stability.

In January 2015, the SNB discontinued the minimum exchange rate and introduced a negative interest rate at the same time. From this point in time, banks and other financial institutions had to pay interest of –0.75% on their deposits held at the SNB. This measure was aimed at preventing the Swiss franc from appreciating too much by making it less attractive compared with other currencies. For the same purpose, the SNB intervened in the foreign exchange market, buying foreign currency against Swiss francs as needed.

The economic recovery after the coronavirus pandemic and the war in Ukraine has led to a global surge in inflation, changing the situation for monetary policy fundamentally.

In June 2022, the SNB initially increased its policy rate to −0.25% before raising it to 0.5% in September 2022. The SNB policy rate thus moved back into positive territory for the first time in almost eight years. In December 2022 and in March 2023, the SNB tightened its monetary policy further, bringing the policy rate up to 1.5%.

By lifting its policy rate, the SNB aims to counter increased inflationary pressure. Moreover, it adjusted the implementation of its monetary policy to the positive interest rate environment. Besides setting the policy rate, the SNB may, if necessary, also use additional monetary policy measures to influence the exchange rate or the interest rate level. These measures include the purchase and sale of foreign currencies in connection with foreign exchange market interventions. This allows the SNB to continue ensuring appropriate monetary conditions.

For the current level of the SNB policy rate, please see ‘Current interest rates and exchange rates’ on the SNB website.