“Waste not in your working life, want not in retirement”. This modified form of the well-known saying “waste not, want not” sums up the basic idea of the Swiss retirement provision system pretty well. After retirement, most of people’s living expenses remain, but suddenly they are not being paid a regular salary. To be able to meet all these expenses, you have to start saving early for life in old age. In Switzerland there are both state and private means of doing so; they all come under the umbrella term of retirement provision.

Retirement provision in Switzerland consists of multiple components, the so-called three-pillar system. The two most important state mechanisms are Old-Age and Survivors’ Insurance (OASI) and the occupational pension (OP, or pension fund) scheme. Added to these is the third pillar, independent provision (private savings). OASI, the first pillar of the Swiss retirement provision system, has evolved to become a national institution. Today it is impossible to imagine retirement provision without this state mechanism.

The OASI pension is designed to enable people to cover their basic living expenses in old age. The main goal is to prevent poverty in old age. OASI also ensures that in the event of the death of a parent or spouse, the survivors do not get into financial difficulty. In addition to the old-age pension, OASI also provides a survivors’ pension in the form of widows’ and orphans’ benefits.

Since 1948, it has been mandatory for everyone living in Switzerland to be insured in OASI, regardless of whether they are employed or not, whether they are an apprentice, student, invalid or householder. OASI contributions must be paid at the latest from 1 January after a person reaches their 20th birthday until they reach normal retirement age. In return, they receive an old-age pension at the age of 65 (the reference age for women will rise from 64 to 65 by three-month increments every year between 2025 to 2028)

OASI functions as a so-called pay-as-you-go system. The special feature of this system is that the pension contributions paid in are passed on directly to the pensioners each month. In other words, rather than being saved, the money is paid out immediately – hence ‘as you go’ (cf. fig. 1). Another term used in connection with the pay-as-you-go system is the intergenerational contract. This is not an actual contract between the generations. The term merely symbolises that the current generation of working people provides the pensions of the current generation of retirement age. This could include, for example, your parents or grandparents.

OASI contributions are deducted directly from the salary on a percentage basis. As at 2024, the rate is 4.35% of a working person’s gross salary. The employer pays the same percentage, in other words also 4.35%. This percentage-based solution means that people with higher salaries or who work full-time pay in more money than those with lower salaries or who work part-time. Example: For an annual salary of CHF 100,000, the OASI fund receives CHF 8,700, and for a salary of CHF 50,000 it receives CHF 4,350 (as at 2024).

There is a maximum pension that applies to everyone, regardless of how much they have paid into OASI in total. This is CHF 2,450 for single people and CHF 3,675 for married couples (as at 2024). There is also a minimum pension, which comes to CHF 1,225 (as at 2024). Over the course of their lives, high earners pay more into OASI than they can draw as pensioners. This financial redistribution from richer to poorer people results in a balance within society.

The pay-as-you-go system works as long as a society has many working people and only a few people in retirement. This was still the case when OASI was introduced back in 1948. Since then, Switzerland’s population structure has undergone major changes, a process referred to as demographic change. The reasons for this are a sharp increase in life expectancy and a lower birth rate since the end of the 1960s.

Demographic change is putting the pay-as-you-go system in jeopardy. The comparatively high life expectancy of 85.8 years for women and 82.2 years for men (as at 2023) means that pensions now have to be paid out for longer. At the same time, the low birth rate means that the number of people paying into OASI is declining. The result is that fewer and fewer people of working age are having to pay for more and more people of retirement age. This ratio is also known as the old-age dependency ratio.

Figure 2 shows that the old-age dependency ratio is declining over time. In 1970, one person of retirement age was provided for by five working people. In 2020 the ratio was already running at 1:3, and by 2050 it is forecast to fall to as low as 1:2. In other words, two working people will have to provide the pension for one person.

| 1970 | 2020 | 2050 | |

| People of retirement age (64/65+ years) | |||

| People of working age (20–64/65 years) | |||

| Ratio of pensioners to people of working age (old-age dependency ratio) | 1:5 (20%) | 1:3 (33%) | 1:2 (50%) |

Source(s): Iconomix, based on the Swiss Federal Statistical Office (2020). Ratio of pensioners to gainfully employed persons and scenarios for development of the population in Switzerland | |||

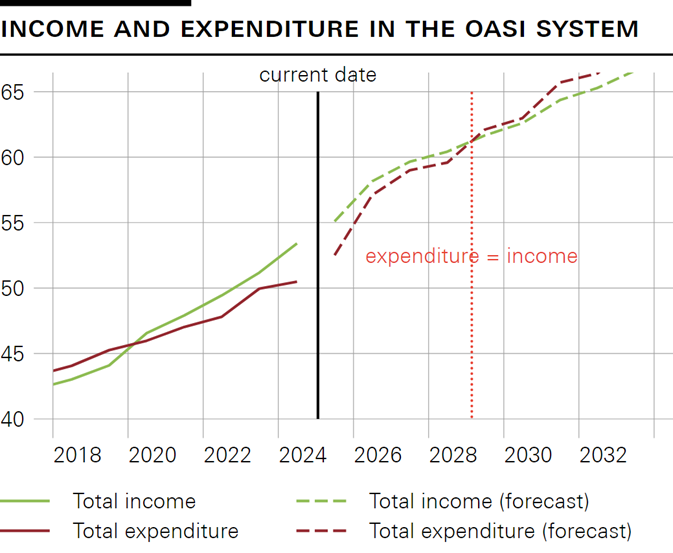

Demographic changes mean that OASI expenditure will soon exceed its income (cf. fig. 3). This will result in a deficit, as more money is paid out than is paid in. This is also referred to as a negative apportionment result. The Federal Social Insurance Office predicts a negative apportionment result for as early as 2029. If nothing is changed in the way the system is funded, additional national debts will then accrue every year. Contributions from employees and employers already account for only 73% of OASI income. The rest comes from the federal government’s contribution, value-added tax, casino levies, etc.

So far, young people coming to Switzerland from abroad and solid economic growth have made it possible to partly offset the deficit in the OASI fund. But these two factors fluctuate and cannot be controlled directly.

Under the ‘OASI 21’ reform, two key measures were introduced to reduce the deficit in the OASI fund. On the one hand, under the reform the retirement age for women was raised to 65 (lower expenditure), and on the other the share of value-added tax used to fund OASI is being raised (higher income).

But more adjustments to the law will be required to make sure that OASI can be funded in the long term. The following reforms are being discussed in this connection: raising the retirement age further, increasing OASI contributions, further increasing existing taxes (such as value-added tax) or levying an additional tax.