Over the past decades, public debt has increased worldwide. Ricardo Reis, professor of economics at the London School of Economics, explains the reasons for this development and gives a prediction for the future course in a video. In this article we summarise the most important insights.

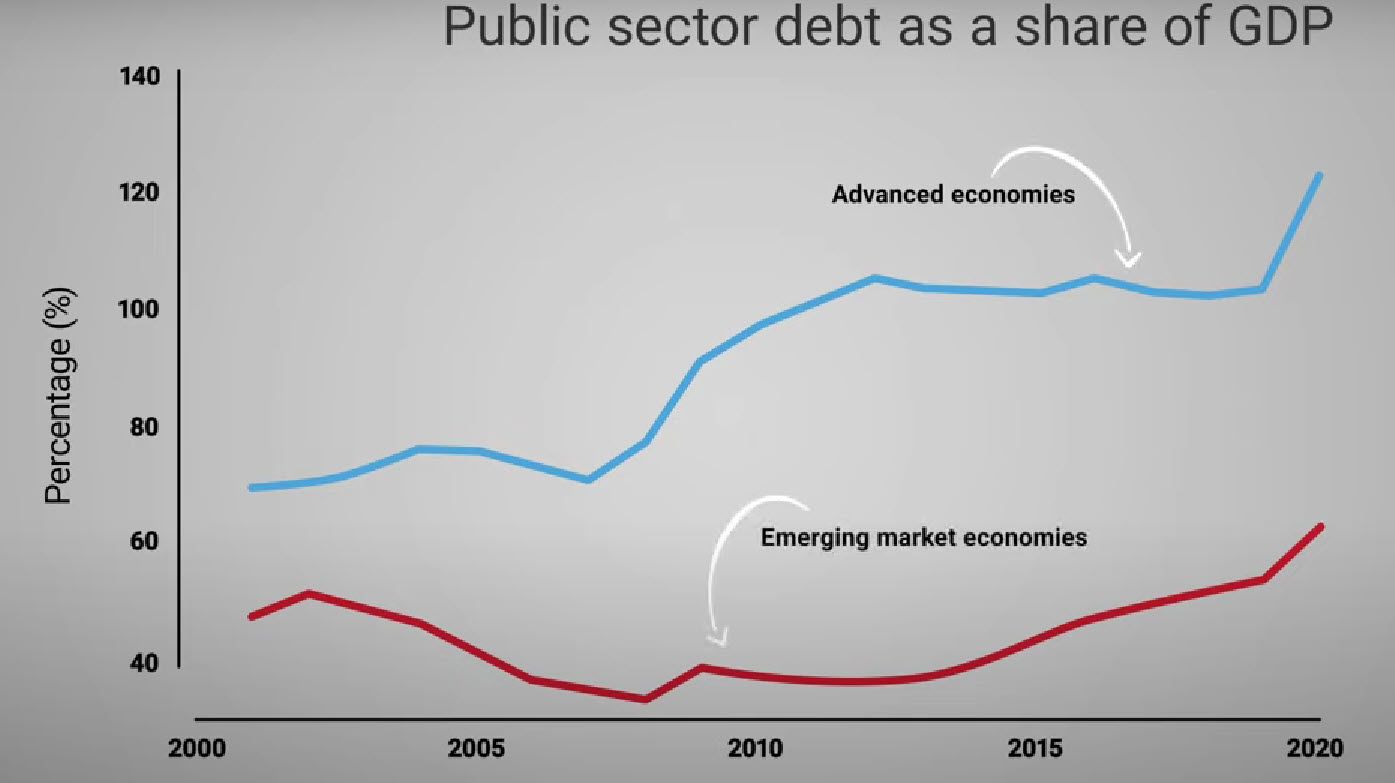

At the end of 2020, the ratio of public debt to gross domestic product (GDP), i.e. the ratio of public debt to a country's economic output (also known as the debt-to-GDP ratio), reached its highest level ever in both advanced and emerging economies (cf. the chart below).

One reason for the increase in public debt was the rise in public spending to mitigate the effects of the Coronavirus pandemic. However, as Reis stresses, public debt had already been steadily rising in the decades preceding the pandemic. During this period, governments had been borrowing more and more.

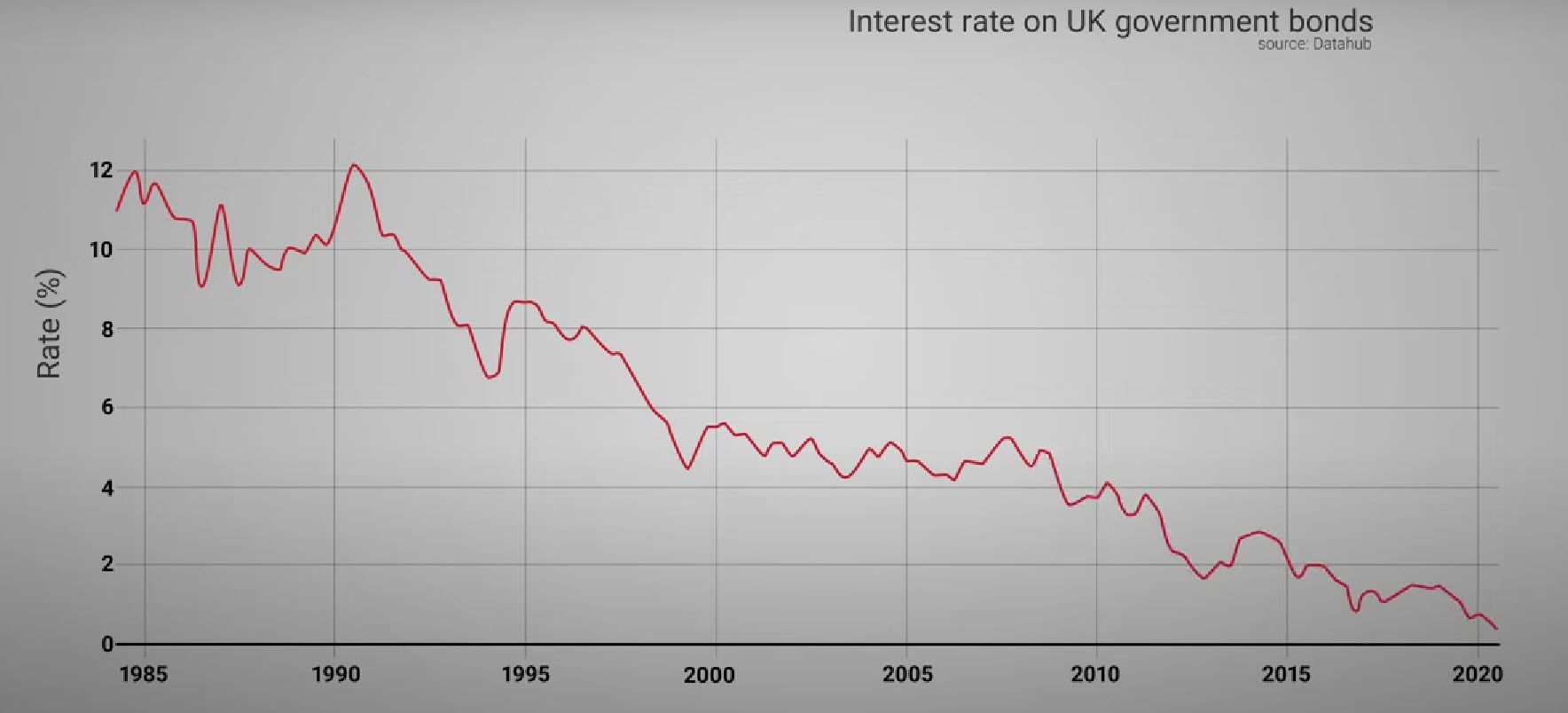

This trend was sustainable due to the decreasing interest rates on government debt (cf. figure 2). As a result, the amount those governments had to pay back to their debtors every year remained relatively stable.

Since 2020, public debt has declined, primarily due to the rise in inflation. With inflation, money loses value. The same applies to financial claims such as government securities: they also lose value. Consequently, the share of government debt in GDP has fallen since 2020.

Reis emphasizes that such an inflation of the debt ratio, as was observed from 2000 to 2020 (first chart), is always only a temporary phenomenon. The key question is whether interest rates will remain at the record low levels seen in the previous 20 years. Reis believes that the answer to this question is no and puts forth four reasons why:

According to Reis, all of this will imply that interest rates on government debt will rise by 1 to 2%, resulting in lower public spending and higher taxes over the next decade.

The full-length video can be watched here.