Economic trends, winter 2023/2024

Every quarter, the Federal Government’s Expert Group publishes a

The winter forecast was presented on 13 December 2023 with a SECO press release and documented in a comprehensive SECO publication entitled ‘Konjunkturtendenzen’/‘Tendances conjoncturelles’ (see illustration opposite).

This publication is freely accessible online in German or French at www.seco.admin.ch/Konjunkturtendenzen.

In this worksheet with integrated advanced text, Iconomix presents a concise summary on the basis of excerpts from the SECO press release and the 24-page SECO publication. It then sets a number of questions on the text. Questions marked with the ✪ icon are advanced questions that go beyond the SECO text and encourage further thought.

The Iconomix summary is structured as follows: As a small economy geared to the global markets, Switzerland is heavily influenced by international economic developments. For this reason, the summary starts with an outline of the global economic situation and the monetary environment. The second section looks into the economic situation in Switzerland in the third quarter of 2023. The third part presents the latest economic forecast for 2024 and 2025, while the fourth explains the risks to economic developments and the forecast.

Slide set with charts and tables

The Iconomix unit ‘Economic trends’ also includes a PDF slide set containing all the charts and tables from the corresponding SECO publication, covering areas such as contributions made by the various economic sectors to GDP growth, global trade and inflation trends.

Real economy

Growth in the major economic areas was slightly stronger than expected overall in the third quarter of 2023, especially in the US and China.

There were considerable differences between the various sectors and countries. The period of weakness in manufacturing continued in the euro area, and industrial output also declined in Japan. The manufacturing sector received substantial impetus from China and the rest of Asia. The US manufacturing sector picked up momentum slightly, and there was very strong growth in US GDP.

Global demand should grow overall this year and next, but at a below-average rate. It is then likely to accelerate somewhat in 2025.

Monetary developments

In many places, inflation continued to ease until the autumn. Inflation rates in many countries are lower than they have been for almost two years. This is partly due to energy and food prices: prices of gas and electricity rose massively last autumn but are now significantly lower again. In addition, there was a further fall in food inflation.

Core inflation – excluding energy and other volatile components – also declined. Despite this, in many places core inflation rates remain clearly above the respective central banks’ targets.

Questions on the international and monetary environment

Briefly describe the current global economic situation.

Briefly describe monetary developments in winter 2023/2024.

✪ Inflation has continued to fall in many places across the world. What are the causes? Give reasons.

✪ In the SECO text it says that in many places, core inflation rates are clearly above the respective central banks’ targets. What does it mean if the core inflation rate is higher than the headline inflation rate? Give arguments.

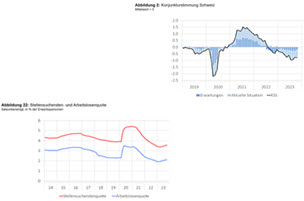

Gross domestic product

In the third quarter of 2023, Swiss GDP adjusted for sporting events saw moderate growth following a slight decline the previous quarter. The trend is thus clearly lagging behind the dynamic growth in the US, but is more favourable than in the euro area, for example, and is at the upper end of expectations.

The weakness of international manufacturing is also affecting the manufacturing sector in Switzerland. Thanks to dynamic exports, however, the less cyclically sensitive chemical and pharmaceutical industry can look back on a positive quarter. Exports of goods (including merchanting) thus proved to be a key pillar of growth in the third quarter. The development of domestic demand, by contrast, was weak.

Labour market

In October, the unemployment rate remained at 2.1%, slightly higher than its low from February 2023.

Prices

Inflation remained relatively low (1.7%) until October, still within the range of 0% to 2% that the SNB equates with price stability.

Questions on the economic situation in Switzerland

Describe how the Swiss economy developed in the third quarter of 2023.

Briefly describe the situation on the Swiss labour market.

Briefly explain how inflation developed.

✪ Why does SECO adjust Swiss GDP for major international sporting events (‘GDP adjusted for sporting events’)? Explain.

✪ The SECO text talks of merchanting in connection with foreign trade. What is meant by this? Explain.

Overview

Overall, global demand is likely to grow more slowly than the historical average in the forecast period and is expected to be curbed by international monetary policy, as before. However, there are currently no signs of a global recession; labour markets have remained solid thus far, and inflation is declining internationally.

Gross domestic product

Against this backdrop, the Expert Group is forecasting economic growth in Switzerland of 1.1% in 2024 compared with 1.3% in 2023 (September forecast: 1.2% for 2024 vs 1.3% for 2023) This would mean significantly below-average growth for the Swiss economy for two consecutive years.

In particular, the subdued momentum in the euro area in 2024 is likely to hold back the exposed sections of the Swiss export industry. Declining capacity utilisation and higher financing costs are expected to curb investment activity. Private consumer spending can still be expected to provide some support; employment should continue to grow, albeit at a slightly slower rate than previously forecast.

The Expert Group expects the global economy and Europe in particular to gradually recover in 2025 from the lull of the previous two years. As a result, Swiss exports and investment will also regain momentum. Overall, the Expert Group forecasts 1.7% growth in GDP adjusted for sporting events in 2025.

Labour market

As a result of the economic slowdown, the average unemployment rate is expected to rise to 2.3% for 2024 and 2.5% for 2025, compared with 2.0% in 2023.

Prices

As in other countries, inflation is also declining in Switzerland. After an annual rate of 2.1% in 2023 as a whole (September forecast: 2.2%), inflation should come in at 1.9% in 2024 (unchanged forecast).

Current business surveys point to easing price pressure thanks to lower purchasing prices and full inventories, coupled with the abolition of industrial tariffs 1 January 2024. On the other hand, however, rising electricity tariffs, VAT adjustment and rent increases are likely to have an inflationary effect.

A significantly lower inflation rate of 1.1% is not expected until 2025.

Questions on the economic forecast

Describe briefly what GDP growth the Federal Government’s Expert Group is expecting for 2023, 2024 and 2025.

Briefly summarise the expectations regarding unemployment for the forecast period.

Explain in a few words how inflation will develop over the forecast period.

Inflation stood at 1.4% in November 2023 and was thus somewhat lower than in the previous months. The text mentions factors that will curb or drive inflation in 2024. Name three factors that will ease price pressure and three factors that will increase it in 2024. Answer in key words.

✪ According to the SECO text, private consumer spending can be expected to provide some support in 2024. Consumers’ willingness to spend is primarily determined by the development of real wages and the labour market situation. In the text the labour market situation is described as good; employment should also continue to grow in 2024. – Why are real wages important in terms of consumers’ willingness to spend, and how do you see real wages developing in 2024? Explain.

Geopolitics

The economic risks are considerable. The geopolitical risks have increased with the armed conflict in the Middle East. An escalation of this conflict could be accompanied by a sharp rise in oil prices and, as a result, rising inflation rates.

Monetary policy

In view of relatively high core inflation, there is still a risk that international monetary policy will have to be tighter than currently assumed. This would further curb global demand.

Financial risks

In addition, existing risks in connection with global debt, risks of corrections on the real estate and financial markets and balance sheet risks at financial institutions could intensify. Against the backdrop of simultaneous interest rate hikes in many countries, the transmission of tighter monetary policy to the real economy could be stronger than currently assumed.

International economy

Developments in Germany and China also pose risks for the international economy and thus for Swiss foreign trade. German industry could slow down more significantly and weaken the exposed areas of the Swiss economy more than expected. The Chinese economy could also cool down more strongly than expected because of the crisis in the property sector, high levels of debt and subdued consumer and business sentiment.

Energy supply

Finally, the risks in the energy sector remain, despite some easing to date. This forecast is based on the assumption that there will be no energy shortages over the entire forecast period. If a severe energy shortage were to occur in Europe, with widespread production losses and a significant downturn, a recession coupled with high price pressure could also be expected in Switzerland.

Questions on the economic risks

This forecast is subject to considerable uncertainty. Name the main downside economic risks mentioned in the text.

✪ In the course of 2021, prices started to rise across a broad front as a result of the coronavirus pandemic (supply bottlenecks and massive increases in government spending). Following the outbreak of the war in Ukraine in February 2022, rising global energy and food prices further fuelled inflation. Central banks in major currency areas began to tighten their monetary policy (raising interest rates). The central banks’ desired scenario is a soft landing. What is meant by this? What are the consequences if this scenario fails to materialise? Explain.