The SNB’s objective is to ensure price stability while taking due account of economic developments. Its most important monetary policy instrument in this pursuit is the SNB policy rate. The policy rate serves as a kind of guide and shows the direction in which the SNB would like to steer its monetary policy.

At the same time, SARON is important for the market and for the implementation of monetary policy. SARON is the actual short-term money market rate created by banks trading money with one another. The market in which this trading takes place is the Swiss franc money market.

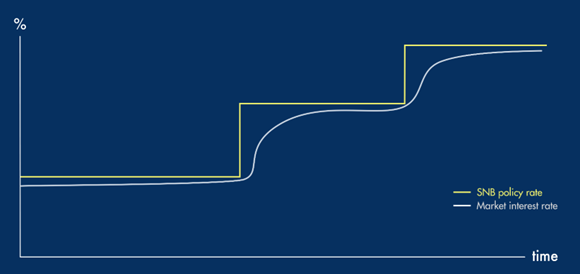

Changes in short-term money market rates are transmitted to the financial markets and from there to interest rates that play a role in our everyday lives – interest rates on savings, loans, mortgages, etc.

The transmission of monetary policy from the policy rate via the short-term money market rates all the way to the interest rates that drive consumption and investment decisions made by households and companies (loan rates, savings rates, mortgage rates, etc.) is indirect and by no means a mechanical process.

In order for the policy rate to be transmitted to SARON, the SNB conducts transactions with banks based on the SNB policy rate. To do this, it uses what are known as open market operations.

Before the financial crisis of 2007/2008, the SNB primarily used repo transactions to keep the money market interest rate close to the monetary policy rate.

Following the onset of that crisis, conventional monetary policy measures were not sufficient to steer monetary policy and stabilise the Swiss franc. For this reason, the SNB also purchased foreign currency and introduced negative interest.

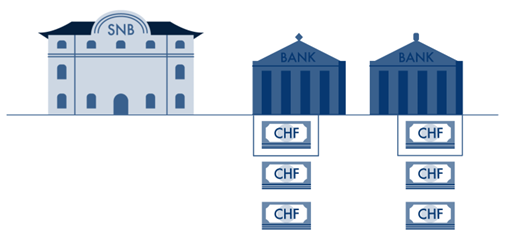

Since 2022, the SNB has been paying interest on central bank money in order to transmit the SNB policy rate to the general level of interest rates. With the system of tiered remuneration, the SNB has ensured that the money market functions even when there is a sharp increase in the supply of money. In addition, the SNB uses liquidity-absorbing open market operations.