Economic trends, summer 2023

Every quarter, the Federal Government’s Expert Group publishes a

The summer forecast was presented on 15 June 2023 with a SECO press release and documented in a comprehensive SECO publication entitled ‘Konjunkturtendenzen’/‘Tendances conjoncturelles’ (see illustration opposite).

This publication is freely accessible online in German or French at www.seco.admin.ch/Konjunkturtendenzen. The main edition of the Swiss TV news programme SRF Tagesschau also covered the forecast on the same day in a report entitled ‘Schweizer Konjunkturaussichten’ (Swiss economic outlook) (2:09).

In this worksheet with integrated advanced text, Iconomix presents a concise summary on the basis of excerpts from the SECO press release and the 29-page SECO publication. It then sets a number of questions on the text. Questions marked with the ✪ icon are advanced questions that go beyond the SECO text and encourage further thought.

The Iconomix summary is structured as follows: As a small economy geared to the global markets, Switzerland is heavily influenced by international economic developments. For this reason, the summary starts with an outline of the global economic situation and the monetary environment. The second section looks into the economic situation in Switzerland in the first quarter of 2023. The third part presents the latest economic forecast for 2023 and 2024, while the fourth explains the risks to economic developments and the forecast.

Slide set with charts and tables

The Iconomix unit ‘Economic trends’ also includes a PDF slide set containing all the charts and tables from the corresponding SECO publication, covering areas such as contributions made by the various economic sectors to GDP growth, global trade and inflation trends.

Real economy

In the first quarter of 2023, in the wake of high inflation and increased interest rates, GDP growth in most advanced economies was relatively weak, albeit better than many confidence indicators and leading indicators would have suggested.

While consumption in Europe remained weak against the backdrop of high inflation, investment in equipment picked up both in Europe and in many other countries, among other things thanks to an easing in global supply bottlenecks.

In China there was a rapid rise in economic activity following the end of the zero-COVID policy. China thus made a substantial contribution to the increase in global manufacturing output.

Monetary developments

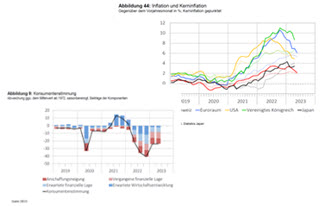

Thanks to the fact that energy prices continued to fall, headline inflation has declined further in most countries in recent months. Core inflation, by contrast, remained high in many countries through to April. Accordingly, the tightening of monetary policy worldwide continued, which had a curbing effect on global demand.

Questions on the international and monetary environment

Briefly describe the current global economic situation.

Briefly describe monetary developments in spring 2023.

According to the text, what were the two main reasons for the relatively weak GDP growth in the advanced economies in the first quarter of 2023? Explain the cause-and-effect relationship.

✪ After reaching temporary highs, global inflation has now eased somewhat. What are the causes? Key words are sufficient.

✪ Why is it taken as a warning signal when core inflation develops less favourably than headline inflation? Give reasons.

Gross domestic product

In the first quarter of 2023, GDP adjusted for sporting events declined by 0.5%, this following a weak 0.0% in Q4 2022. Economic growth in Switzerland was thus in the upper range by European comparison.

Domestic demand showed a solid increase in the first quarter of 2023. Despite further rises in consumer prices, private consumption grew substantially, supported by a strong labour market.

In the first quarter there was further impetus from foreign trade in goods. With exports showing broad-based growth across a range of categories and countries, Swiss manufacturing saw moderate growth in value added.

Labour market

The labour market is still in good shape. In April, the seasonally adjusted unemployment rate stood at 1.9%, unchanged since December 2022.

Prices

After an increase to 3.4% at the beginning of the year, due primarily to high electricity prices, by May inflation had fallen back to 2.2%, its lowest level since a year ago.

This decline is above all attributable to lower prices for oil products and natural gas, with energy and fuels contributing just 0.4 percentage points to inflation. This is the lowest figure since April 2021.

However, underlying inflationary pressures remain elevated. Core inflation was above 2% for the third month running.

Questions on the economic situation in Switzerland

Describe how the Swiss economy developed in the first quarter of 2023.

Briefly describe the situation on the Swiss labour market.

✪ In June 2023, the Swiss National Bank raised its policy rate by 0.25 percentage points, the fifth consecutive increase. The SNB policy rate currently stands at 1.75%. What is the SNB trying to achieve when it raises the policy rate? Explain.

✪ In addition to raising its policy rate, in recent months the SNB has also sold foreign currency to achieve its monetary objectives. Explain what the SNB intends to achieve by selling foreign currency and how it influences the Swiss franc by doing so.

Overview

There are signs that the Swiss economy will weaken markedly in the second quarter. The labour market should cool down somewhat.

The further course of the economy will depend to a significant extent on global economic developments and the energy supply situation.

GDP

The Federal Government’s Expert Group has confirmed its March economic forecast. Its GDP growth forecasts remain unchanged at 1.1% for 2023 and 1.5% for 2024 (adjusted for sporting events).

As previously, the forecasts are based on the assumption that during the coming winter of 2023/2024 there will be no energy shortages with widespread production losses. At the same time, gas and electricity prices are expected to remain high by historical standards.

Labour market

The economic slowdown is likely to also have a delayed effect on the labour market. After an annual average of 2.0% for 2023, the unemployment rate is projected to be 2.3% in 2024.

Prices

Given the lower energy prices, inflation is likely to be somewhat lower this year than previously assumed at 2.3% (March forecast: 2.4%), and in 2024 it should return to the range consistent with price stability (unchanged at 1.5%). On the one hand, rents are likely to rise significantly owing to the higher reference interest rate, and on 1 January 2024 there will be an increase in value added tax. On the other hand, lower energy and purchase prices will curb price developments in other areas.

Overall, inflation in Switzerland will still be significantly lower than in other advanced economies over the entire forecast period. It can therefore be assumed that monetary policy tightening will also be less pronounced in Switzerland.

Questions on the economic forecast

Describe briefly what GDP growth the Federal Government’s Expert Group is expecting for 2023 and 2024.

Briefly summarise the expectations regarding unemployment for the forecast period.

Explain in a few words how inflation will develop over the forecast period.

✪ In the text it says that rents are likely to increase significantly owing to an increase in the reference interest rate. What is this reference interest rate? Why has this reference interest rate been increased? How are this reference interest rate, rents and inflation related? Explain.

Monetary policy

The global economic situation is fragile and the risks are pronounced. Inflation could turn out to be more persistent internationally and require a more restrictive monetary policy. This would further curb global demand. Existing risks associated with the sharp increase in global debt as well as risks of corrections in the real estate and financial markets would intensify.

Financial risks

Against the backdrop of rapid and simultaneous monetary policy tightening internationally, balance sheet risks could arise or grow for financial institutions, with potential repercussions in terms of financial stability. The knock-on effect on the real economy could also be more serious than currently expected.

Energy supply

Lastly, despite the current easing, the risks of energy shortages in the coming winter of 2023/2024 remain. If a severe energy shortage were to occur in Europe, with widespread production losses and a significant downturn, a recession coupled with high price pressure could also be expected in Switzerland.

Questions on the economic risks

Name the main downside risks mentioned in the text.

✪ The text mentions corrections on the real estate markets, specifically because of more restrictive monetary policy. Why does more restrictive monetary policy have a dampening effect on the real estate market? Give arguments.

✪ On 19 March 2023, the Federal Council, the Swiss Financial Market Supervisory Authority (FINMA) and the Swiss National Bank announced the acquisition of Credit Suisse (CS) by UBS. This had been preceded by a crisis at CS that had come to a head over a period of months. – Describe what the bankruptcy of CS would have meant for Switzerland and the international financial system.