Economic trends, winter 2022/2023

Every quarter, the Federal Government’s Expert Group publishes a

The winter forecast was presented on 13 December 2022 with a SECO press release and documented in a comprehensive SECO publication entitled ‘Konjunkturtendenzen’/‘Tendances conjoncturelles’ (see illustration opposite).

This publication is freely accessible online in German or French at www.seco.admin.ch/Konjunkturtendenzen.

In this task, Iconomix presents a concise summary on the basis of excerpts from the press release from SECO and the 26-page SECO publication. It then sets a number of questions on the text. Questions marked with the ✪ icon are advanced questions that go beyond the SECO text and encourage further thought.

The Iconomix summary is structured as follows:

As a small economy geared to the global markets, Switzerland is heavily influenced by international economic developments. For this reason, the summary starts with an outline of the global economic situation and the monetary environment. The second section looks into the economic situation in Switzerland in the past quarter, while the third presents the latest economic forecast. The fourth part of the summary explains the risks to economic developments and the forecast.

Slide set with charts and tables

The Iconomix unit ‘Economic trends’ also includes a PDF slide set containing all the charts and tables from the corresponding SECO publication, covering areas such as contributions made by the various economic sectors to GDP growth, global trade and inflation trends.

Real economy

Growth in the global economy accelerated somewhat in the third quarter of 2022, despite a difficult environment of rising prices and the war in Ukraine. In China, GDP increased following the lifting of coronavirus measures. Europe looks to have benefited from the fact that the services sector has further recovered from the coronavirus pandemic. Added to this, a certain easing in international supply bottlenecks has led to a recovery in manufacturing output.

However, in an environment of high energy and food prices, inflationary pressures have remained high internationally. High prices are weighing on the purchasing power of private households.

Monetary developments

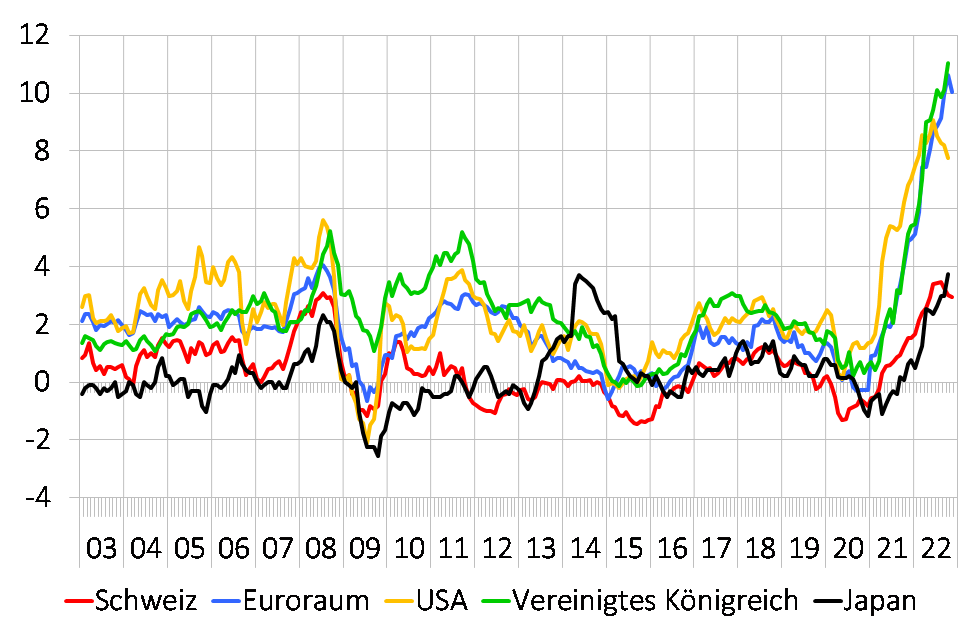

Global inflation fell somewhat in autumn, mainly thanks to the declining price of crude oil. Core inflation, by contrast, remained high in many places or, as in the euro area, even increased. Inflation thus remains at a decidedly high level (see illustration below).

Illustration from SECO’s ‘Konjunkturtendenzen’/‘Tendances conjoncturelles’ publication:

Inflation in selected countries

Percentage changes compared to the same month one year earlier

Sources: BFS, Eurostat, U.S. BLS, ONS, Statistics Japan

Questions on the international and monetary environment

Describe the current global economic situation.

How would you describe monetary developments?

✪ It says in the text that high prices are weighing on the purchasing power of private households. Explain the connection between growing inflationary pressure and declining demand.

✪ In the last few months inflation has risen sharply worldwide, reaching levels last seen 40 years ago. What are the causes of this sudden rise in prices?

Overview

Switzerland’s GDP growth in the third quarter came in within expectations, driven in particular by domestic demand. Private consumption increased robustly, partly reflecting a post-pandemic catch-up effect in the tourism and leisure sectors.

Gross domestic product

Switzerland’s GDP grew by 0.2% (seasonally and sport event adjusted) in the third quarter after 0.1% the previous quarter.

Labour market

Unemployment continued to decline in October, with the rate remaining at a seasonally adjusted 2.1%. There was a moderate increase in employment levels in the third quarter.

Prices

In August inflation reached 3.5%, its highest level since the 1990s. By October it had fallen back to 3.0%, mainly owing to lower oil prices and the higher value of the Swiss franc.

Questions on the economic situation in Switzerland

How did the Swiss economy develop in the third quarter of 2022?

What was the situation on the labour market?

How did inflation develop?

✪ In the text it says that inflation has declined partly because of the higher value of the Swiss franc. Explain.

✪ In mid-December 2022, the SNB raised its policy rate for the third time in a row, this time by half a percentage point. The rate is currently 1%. What is the SNB trying to achieve when it raises its policy rate? Describe.

Overview

The further course of the economy will depend to a crucial extent on the course of the global economy and on the supply of energy. The Expert Group’s forecast is based on the assumption that there will be no energy shortages entailing widespread production losses, either this or next winter. However, the energy situation in Europe is likely to remain tense and the prices of gas and electricity high. In addition, high international inflation and monetary tightening are likely to curb global demand.

GDP

Against this backdrop, the Expert Group is forecasting economic growth in Switzerland of 1.0% in 2023 (September forecast: 1.1%), compared with 2.0% in 2022 (unchanged forecast). This would point to sluggish growth for the Swiss economy, but not a severe recession.

Looking further ahead, Europe’s energy situation is projected to gradually normalise after a tense 2023/24 winter. At the same time, inflation rates will likely ease worldwide and the global economy should gradually gain momentum. This would also trigger a recovery in Switzerland. For 2024 as a whole, the Expert Group forecasts growth of 1.6%, which is slightly below average.

Labour market

The economic slowdown is also likely to be reflected in the labour market, with unemployment expected to edge up from an average of 2.2% in 2022 to 2.3% in 2023. Unemployment is expected to continue rising, averaging 2.4% for the year.

Prices

High energy prices are a factor in the relatively high inflation rates expected for Switzerland too: 2.9% in 2022, followed by 2.2% in 2023and 1.5% in 2024.

Questions on the economic forecast

What GDP growth is the Federal Government’s Expert Group expecting for 2023 and 2024?

What rate of unemployment is expected for the forecast period?

How will inflation develop over the forecast period?

✪ The further course of the economy will depend to a crucial extent on global economic developments and the supply of energy. The Federal Government’s Expert Group expects global demand to develop at a below-average rate over the next two years. This will also affect the exposed areas of Swiss foreign trade. What is there to suggest that Switzerland will nevertheless come through the next few quarters relatively unscathed by international standards?

Energy shortages

The likelihood of facing an energy shortage this winter has diminished recently. However, such a risk for the 2023/24 winter is now emerging. In particular, the situation could come to a head if Europe’s gas storage facilities are already heavily used in the coming months. If a severe energy shortage were to occur in Europe, with large-scale production losses and a significant downturn, a recession twinned with high price pressure could also be expected in Switzerland.

Monetary policy

There is also the risk of monetary policy having a greater impact on the real economy than assumed. Inflation could prove more persistent internationally than previously thought, which could require a tighter monetary policy stance.

Financial and real estate markets

In view of rising interest rates, the risks associated with the sharp increase in global debt have also increased. The risk of financial market corrections remains high. Risks also persist in the real estate sector, both domestically and internationally.

Pandemic

Pandemic-related setbacks cannot be ruled out, for example as a result of new virus variants. In particular, China’s economy could be further weakened by strict containment measures, with repercussions on the global economy.

Positive risks

It is also possible, however, that the economy will fare better than projected. This could happen, for example, if the energy situation over the coming quarters turns out to be less severe than expected or eases more quickly. Such a positive scenario would likely mean lower inflation rates and more robust demand at home and abroad.

Questions on the economic risks

Describe the main downside risks.

There are also positive risks. Please give an example.

✪ In recent weeks the probability that there will be a shortage of gas or electricity in Europe or Switzerland this winter has declined. How would the course of the economy be affected if rationing or even interruptions in the energy supply were nevertheless to become necessary?

✪ There are growing signs that price increases are increasingly spreading to goods and services not directly affected by the war in Ukraine or supply bottlenecks. This increases the danger that inflation will become entrenched. In connection with such dynamics, there is sometimes talk of ‘second-round effects’ or a ‘wage-price spiral’. What is meant by these two terms?