The future of retirement provision

Introduction to the topic

Watch the short video on poverty in old age and answer the question below.

What can you do in the years to come to protect yourself from poverty in old age? List at least three effective actions.

History of retirement provision in Switzerland

First read the following cloze text. Then watch the short video on the history of the Swiss retirement provision system and fill in the gaps with the following terms and years/numbers:

40 / 62 / 65 / 1948 / 3-pillar system / basic living expenses / poverty in old age / savings measures

History of retirement provision in Switzerland

OASI was introduced in , a year after the successful referendum in 1947. At first the pensions paid were very modest, between CHF and CHF 125 per month.1 The retirement age, on the other hand, was right from the outset. Only later was it gradually reduced to and then raised back up to 64 for women. With the adoption of the ‘OASI 21’ reform by the people and the cantons in September 2022, the retirement age for women was raised from 64 to 65.

The basic goal of OASI is to prevent . As it soon became clear that an old-age pension alone was not sufficient to guarantee the constitutional right for people to have their covered, the welfare system was continuously expanded. However, during the economic crisis in the 1970s, for example were also introduced. The , which has been enshrined in the Federal Constitution since 1972, is still in place.

[1] At that time the average income in the manufacturing industry was CHF 745.

The 3-pillar principle

Read How does retirement provision work in Switzerland at present? in the factsheet. Then fill in the missing elements in the diagram below. Use the following terms:

continuation of the accustomed standard of living / further needs / OASI / pay-as-you-go system / pension fund (OP) / private provisions / state pensions

| Name | 1st pillar = | 2nd pillar = |

3rd pillar = pillar 3a |

| Organisation | Occupational pensions | ||

| Objective | covering basic living expenses (livelihood) | ||

| Funding method | fully-funded system | fully-funded system |

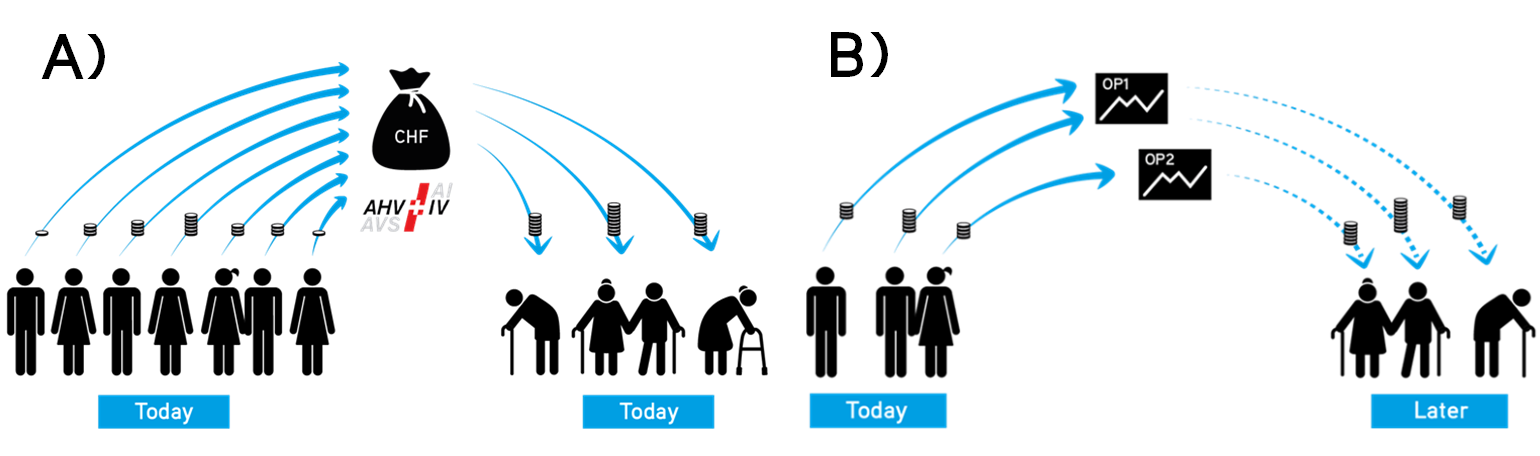

Assign the correct definition to each of the two illustrations and name the pillar in the pension scheme that is based on this method.

Source(s): Iconomix, based on a Federal Social Insurance Office graphic.

1) The amounts paid in by each person subject to contributions are accumulated in a personal account at a pension fund and invested on the capital market. From the time of retirement, the interest-bearing funds are paid back to the insured person in the form of a pension.

2) The amounts paid in by people subject to contributions are used directly to fund current benefits (pensions).

| Figure | Definition | Name of pillar |

| A | ||

| B |

Challenges faced by OASI and possible solutions

When the Swiss retirement provision system was created, the societal and economic circumstances were different to now. The purpose of the following task is to discuss possible solutions to the challenges currently faced by OASI.

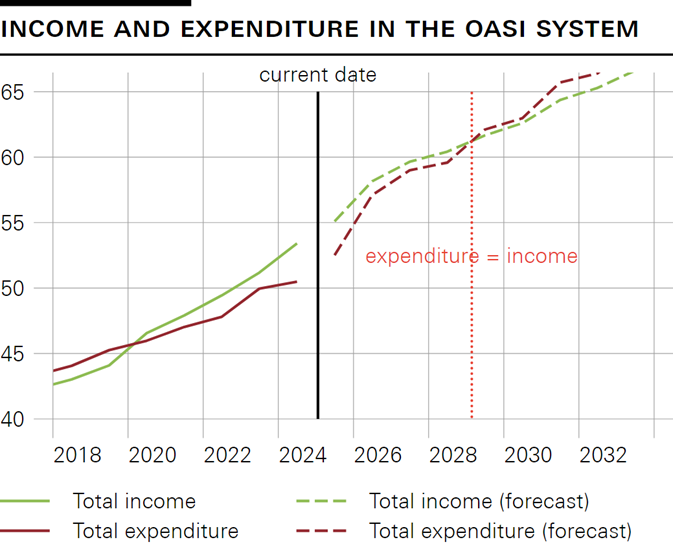

Start by reading What are the challenges faced by retirement provision? in the factsheet, focusing on the 1st pillar. Then study the chart below and on that basis decide whether the following statements are true or false.

Source(s): Federal Social Insurance Office FSIO (2025)

Infobox: Any forecast is based on a model (a simplified representation of reality) with certain assumptions. For example, predicting the development of the OASI system requires an estimate of how much wages will grow in the future. Some of these assumptions are uncertain and politically controversial. Therefore no forecast is exact. The forecast in the upper chart comes from the Federal Social Insurance Office (FSIO). The FSIO is obliged to provide a forecast that is as neutral and realistic as possible.

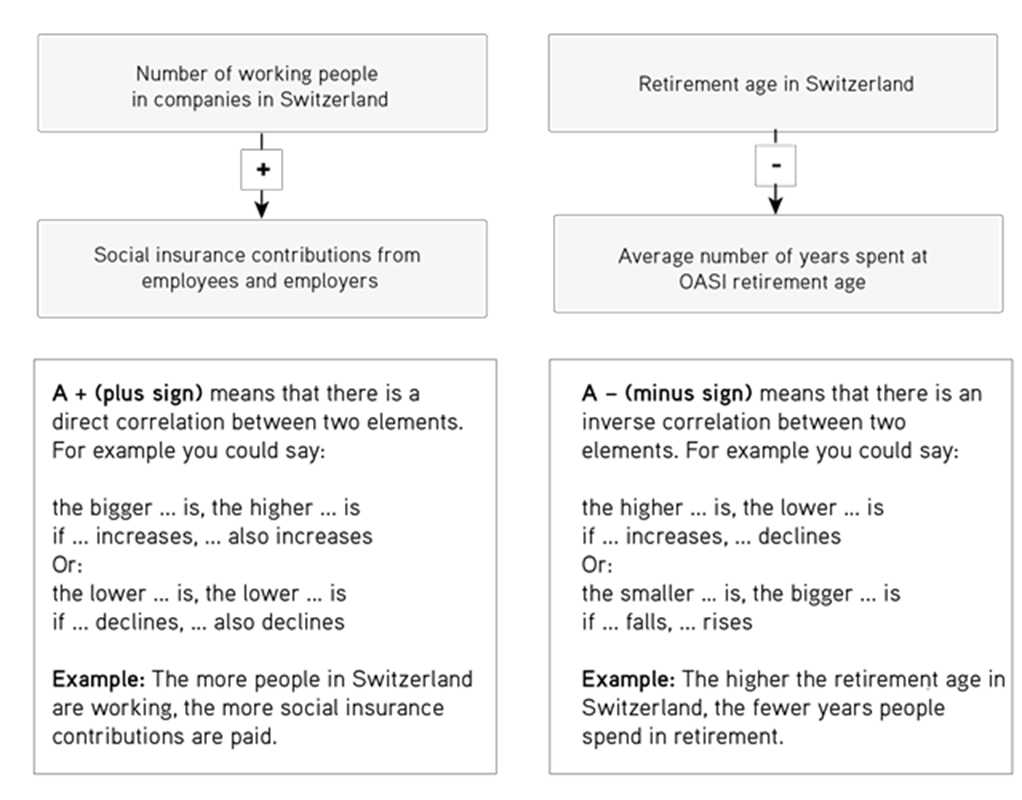

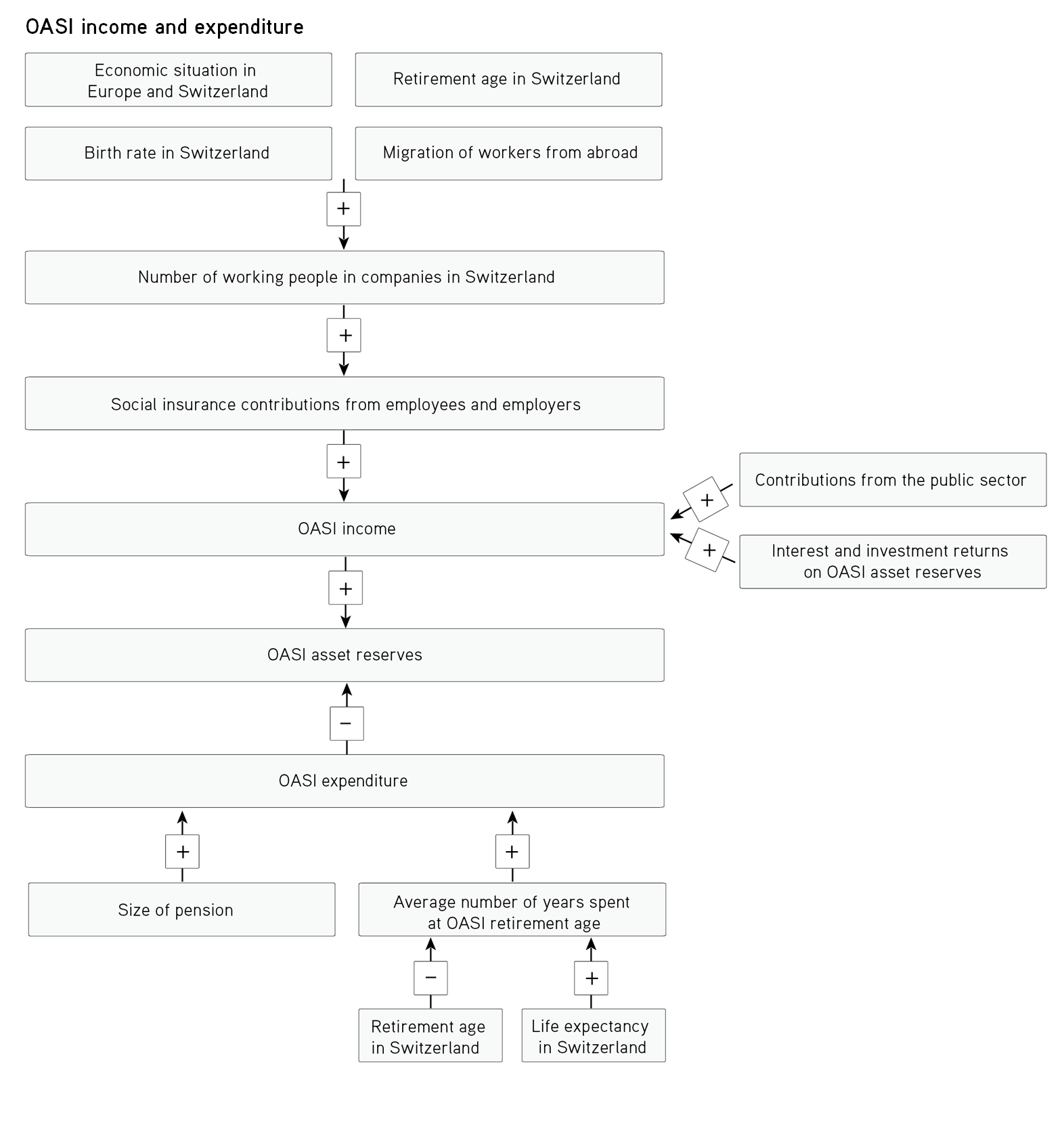

Look at the following reading aid and read the notes in the boxes. Make sure that you have understood them. Then study the chart ‘OASI income and expenditure’ on the next page.

Asset reserves: OASI’s asset reserves form the so-called OASI fund. If the expenditure is less than the income in a given year, the surplus is paid into the fund. The fund serves as a reserve to even out fluctuations in income and expenditure. The more assets are in the OASI fund, the healthier OASI is in financial terms.

The section entitled What are the challenges faced by the retirement provision system? mentions the ageing of the population as a key challenge faced by the retirement provision system. The challenge stems from the low birth rate and constantly increasing life expectancy.

With the help of the chart in task 4b), explain the effect of the two causal factors on the OASI’s asset reserves. Select the correct solution in the following text.

If the birth rate is low, there are working people. social security contributions are paid in and income as a result. As a result, the asset reserves get .

If the life expectancy is high, pensioners spend years in retirement. This means expenditure and the asset reserves .

Now read What kind of solutions are being discussed? in the factsheet. Then decide whether the following measures will help secure the funding of OASI sustainably.

Decide whether the measure in question will increase income and/or reduce expenditure. The table contains an example showing you what is meant.

Tip – use the chart from task 4b) to help you.

|

Measure |

Sustainable funding |

Income (↑) |

Expenditure (↓) |

|

Higher contributions from employees and employers |

Yes |

Increases income |

Does not reduce expenditure |

|

Reducing pensions |

|

|

|

|

Limiting immigration |

|

|

|

|

Raising retirement age further |

|

|

|

|

Raising value-added tax further |

|

|

|

|

Reducing conversion rate |

|

|

|

|

Introducing a new tax |

|

|

|

Consider the labour market. Raising the retirement age could entail certain difficulties. Describe such difficulties, both for employees and employers.

The accumulation and reduction of retirement assets in the OP (= pension fund)

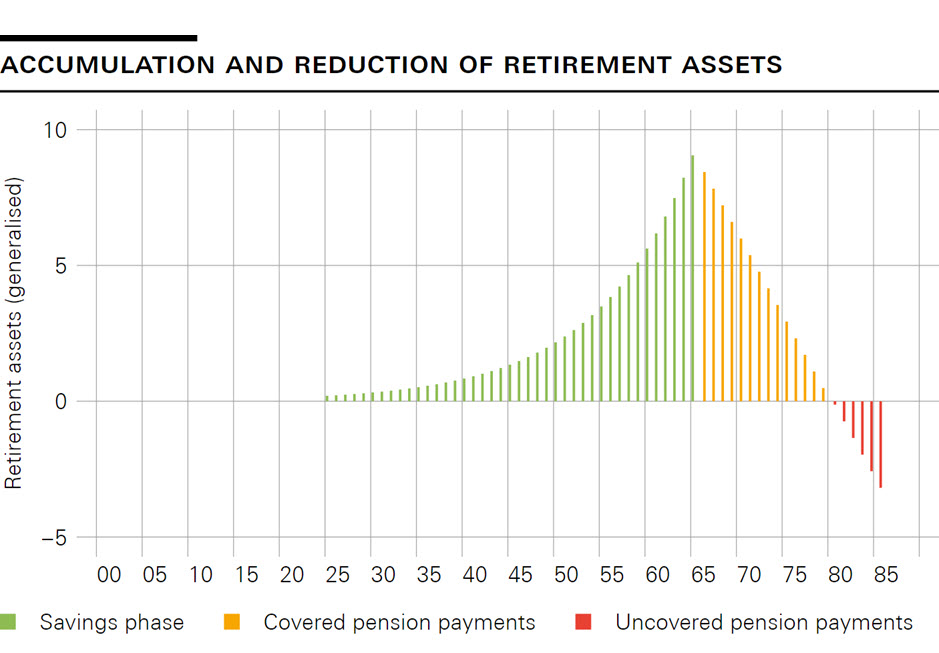

First study the chart below. Then assign the three explanatory texts to the relevant life phase.

Source(s): Iconomix, based on chart from AXA Insurance.

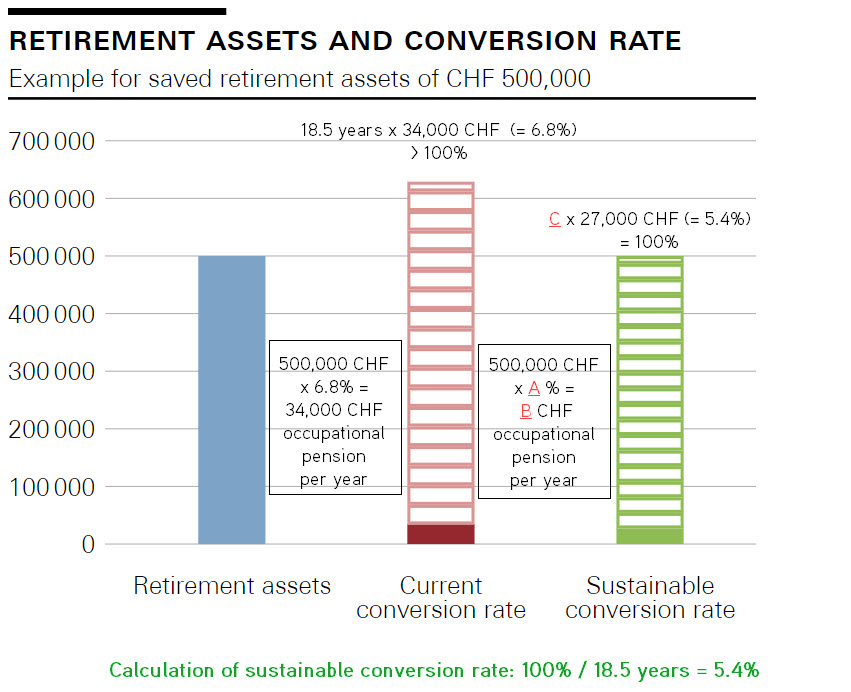

First read the following infobox. Then fill in the gaps in the chart below using the following aids:

Infobox: Pensions in the second pillar are calculated on the basis of a fixed conversion rate. This rate is currently running at 6.8% (as at 2025). This means that 6.8% of a pensioner’s accumulated balance is paid out each year. At that rate, their retirement assets will be used up after just under 15 years.

Life expectancy in Switzerland is, however, currently running at around 84 years (men 82.2 years, women 85.8 years). This means that with the retirement age set at 65, pensioners spend a good 18.5 years in retirement on average.

The result: On average, people draw pensions for longer than their retirement savings will last at a conversion rate of 6.8%. So the conversion rate is currently too high. This means that the pensions paid out each year are too large.

| A | |

| B | |

| C |

Challenges faced by the OP (= pensions fund) and possible solutions

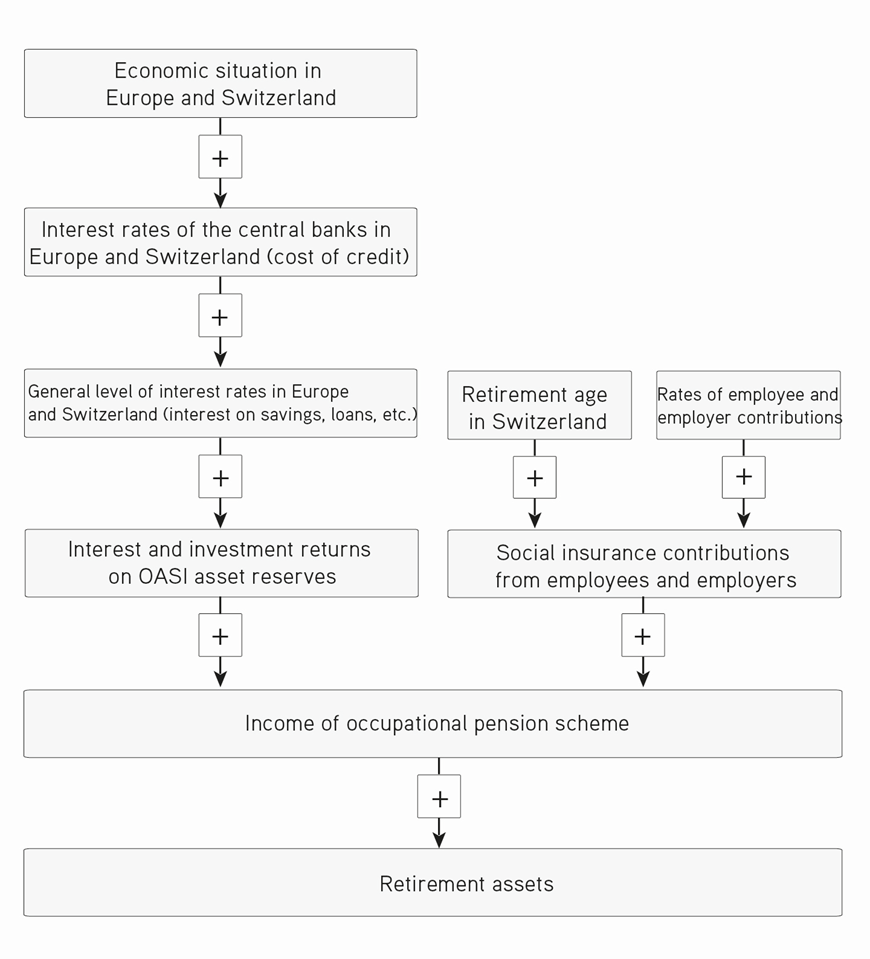

The following task addresses factors that influence the income of occupational pension funds and discusses possible solutions to the challenges they are facing today.

As in task 4b), first study the chart below.

Read the following statements and check the boxes of the statements that are true. For each false statement, briefly explain why it is not correct.

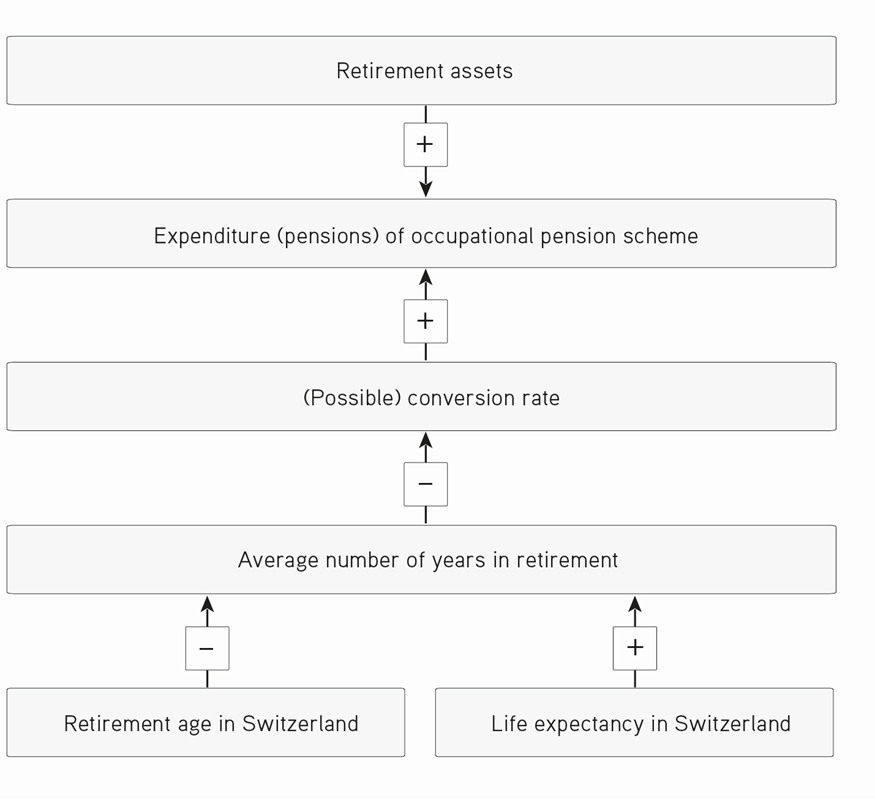

Study the chart below. Make sure that you have understood before continuing with task 6c).

Now read What kind of solutions are being discussed? in the factsheet again. Then decide whether the following measures will help secure the funding of occupational pensions sustainably.

Decide whether the measure in question will increase income and/or reduce expenditure. The table contains an example showing you what is meant.

Tip – use the chart from task 6b) to help you.

|

Measure |

Helps fund OP sustainably (yes/no) |

Income (↑) |

Expenditure (↓) |

|

Higher contributions from employees and employers |

Yes |

Increases income |

Does not reduce expenditure |

|

Limiting immigration |

|

|

|

|

Raising retirement age further |

|

|

|

|

Raising value-added tax further |

|

|

|

|

Reducing conversion rate = reduce pensions |

|

|

|

Model of retirement provision for future generations: Pegging

First read tasks 7b), 7c) and 7d) and then watch the short video ‘Pegging retirement age to life expectancy in Denmark‘.

Explain in two or three sentences what pegging the retirement age entails. Tip – to do so, include a sentence structured as follows: The … society becomes on average, the …

Fill in the gaps in the cloze text with the following terms:

economic growth / life expectancy / political / retirement age

In some countries a form of pegging already exists. In Denmark, for example, the amount of pensions depends on This means that pensions increase or decline automatically without influence. In Sweden, the is also linked to .

Assess whether the two following statements relating to the video are true or false. Check the boxes.

Model of retirement provision for future generations: Working lifetime

One potential reform in Switzerland involves linking the time of retirement to the number of years paid in, rather than to age.

Under the proposal, a bricklayer who started working at 18 could retire at 62 with a full pension. What are the consequences of the proposal for someone who enters the workforce later (e.g. owing to studies) or has taken a break from work (e.g. to have children or for further education)? Select all the correct answers.

According to the trade unions, which groups of people would have to live with the greatest deterioration under the proposal? Put a cross next to all the correct answers!

Write a short commentary (6 to 10 sentences) describing how you would stabilise the retirement provision system. Make sure that your proposal would have majority support. In your description and argument, be sure to use the terms ‘salary contributions’, ‘cuts in pensions’, ‘retirement age’ and ‘taxes’.